are raffle tickets tax deductible if you don't win

An organization that pays raffle prizes must withhold 25 from the winnings and report this amount to the irs on form w. Are raffle tickets tax deductible if you dont win.

Thats because you are not actually making.

. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Winners are encouraged to consult a tax professional. Are raffle tickets tax deductible if you dont win Friday February 11 2022 Edit.

The IRS considers a raffle ticket to be a. Essentially if you want a tax deduction dont do a charity raffle. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. One way to write off your raffle ticket is as a gambling loss. Please remember even if you dont win this raffle item.

Are raffle tickets tax deductible if you dont win. Are Raffle Tickets Tax Deductible If You Dont Win. The IRS allows you to write off gambling expenses but only up to the amount of your winnings.

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. Are raffle tickets tax deductible if you dont win. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses. If you buy 20. If you win a charity.

If youre lucky enough to. Are Raffle Tickets Tax Deductible The Finances Hub Are Nonprofit Raffle Ticket Donations. Thats because you are not.

If you dont win are raffle tickets tax deductible. The IRS allows you to write off gambling expenses but only up to the amount of your winnings. Unfortunately purchasing a raffle ticket to benefit a non-profit organization is not a tax-deductible expense.

Ask your local tax professional if you have any questions. Although you cannot take a. Are raffle tickets tax deductible if you dont win.

Are Raffle Tickets Tax Deductible If You Dont Win. Are raffle tickets tax deductible if you dont win. Is it possible that tickets are.

Only do a charity raffle if you want to potentially win cool prizes but feel OK receiving nothing in return. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. Thats because you are not actually making.

2022 Mma Fundraiser Jeep Raffle Ticket Mahwah Municipal Alliance

Golden Ticket Raffle Fowlerville Family Fairgrounds

How To Get A Tax Deduction For Supporting Your Child S School

Raffles As An Irs Donation Deduction Budgeting Money The Nest

Tax Deductions You Should Claim And Five You Can T Prosperity Thinkers

4000 In Visa Prepaid Debit Cards Raffle Creator

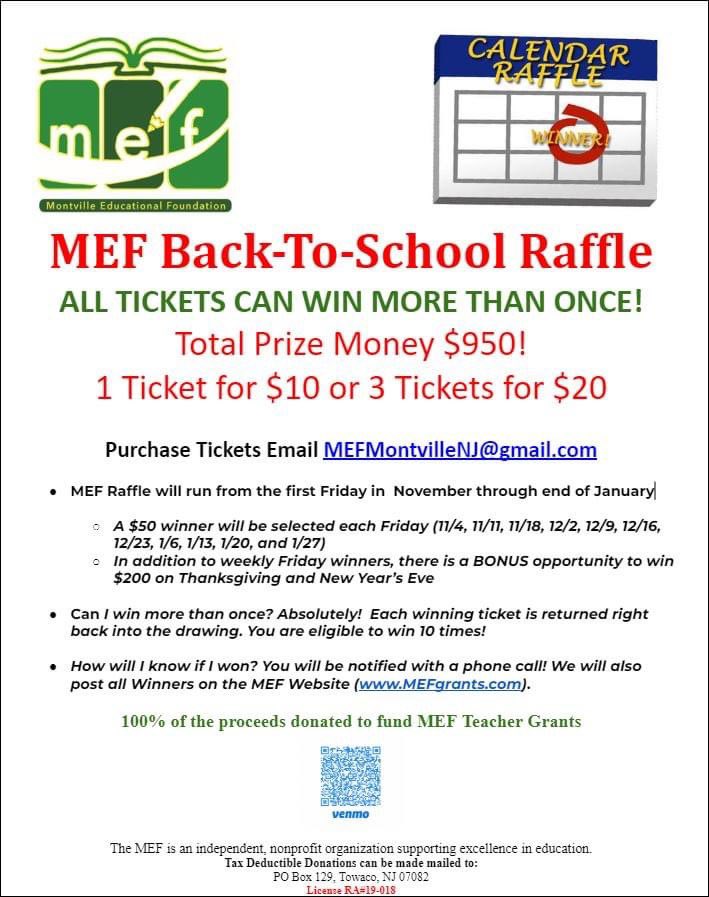

Montvilleeducationalfoundation Montvilleeduca1 Twitter

Tax Tip Donations You Can T Deduct Thestreet

Are Nonprofit Raffle Ticket Donations Tax Deductible

New Year S Resolution For Nonprofit Fundraising 101 Know The Law And Follow It

The Working Lunch Raffle Women Employed

2023 Vacation Raffle Havenhouse St Louis Fundraiser Raffle

Macomb Food Program Macombfoodpro Twitter

Event Details St Mary Armenian Apostolic Church

East Prairie School On Twitter Reminder The Eps Educational Foundation S Fundraiser Is This Friday Night Including A Virtual Trivia Night A Raffle And Local Food Benefitting The Cause Please See The Flyer

Taxes On Prize Winnings H R Block

Winning Scc 50 50 Raffle Ticket News Media Las Vegas Motor Speedway