income tax rates 2022 uk

For the tax year 20212022 the UK basic income tax rate was 20. Income Tax for England Wales Northern Ireland.

Ryan Cooper On Twitter So During The Worst Inflation Spike In 40 Years The Uk Government Is Going To Cut Taxes By 12 6 Percent Of Gdp What Https T Co Cfdjsqhqbg Https T Co Oltupgjvff Twitter

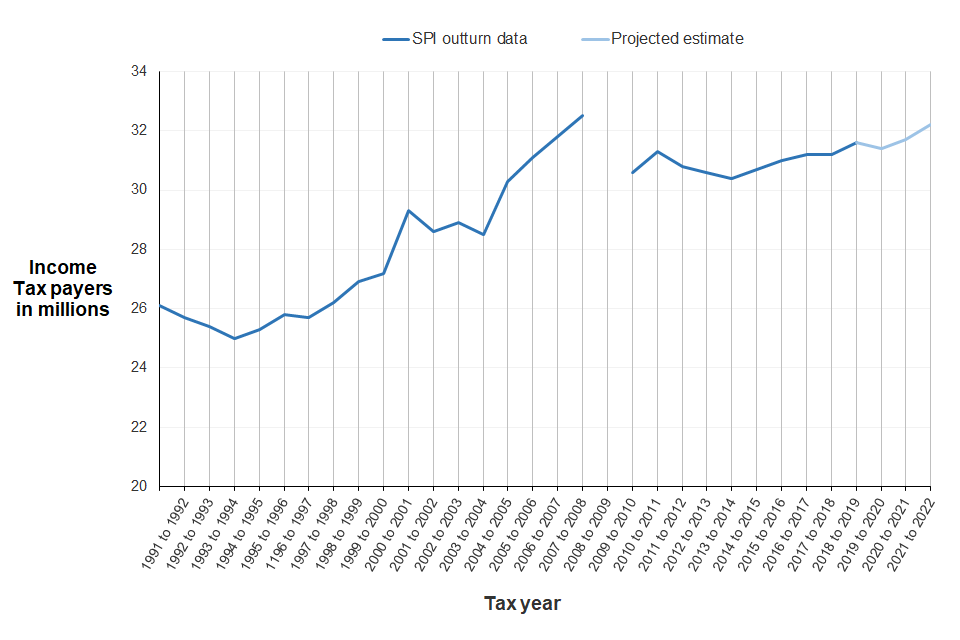

Income tax is the highest tax revenue generator for the UK treasury bringing in around 192 billion for the 202021 tax year.

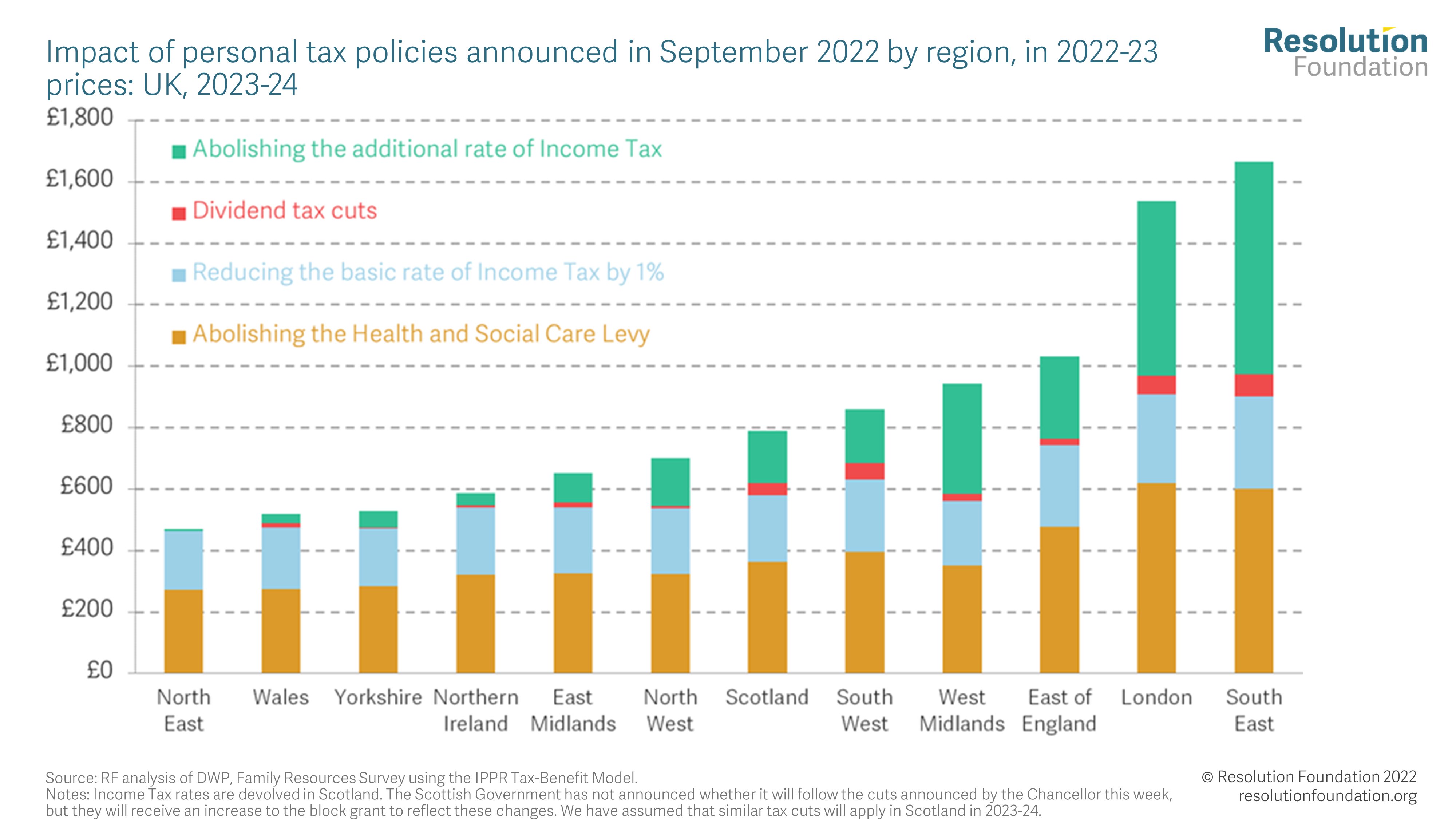

. Finance minister Kwasi Kwarteng sent shockwaves through financial markets when he published a mini-budget on Sept. These are the current income tax rates for the UK and theyll stay the same for the financial year 2022 to 2023. A small number of extremely high-income.

For example if your accounting period is 1 January 2017 to 31 December 2017 you pay. Employee earnings threshold for student loan plan 1. 23 cutting taxes including the 45p highest rate of.

25900 1400 1400 1400. UK income tax rates vary depending on the amount of taxable income earned. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

The higher rate threshold. Kwarteng slashed the top rate of income tax paid by those earning over 150000 161327 to 40 from 45. This increased to 40 for your earnings above 50270 and to 45 for earnings over 150000.

ST Secondary Threshold. For 20222023 only the Directors Pro Rata Annual Threshold is 11908. Personal Allowance for people aged 65 to.

United Kingdom Non-Residents Income Tax Tables in 2022. The Growth Plan 2022. 25 February 2022 3 mins Self Assessment.

Before the 2013 to 2014 tax year the bigger Personal Allowance was based on age instead of date of birth. It benefited from climbing interest rates including in the UK where the Bank of England has increased rates to 225 from record lows of 01 last year in an attempt to. LEL Lower Earnings Limit.

What are the income tax rates 202223 in the UK. 15 Votes Scotland has separate Income Tax Rates and Bands in 2022 your salary calculations will use. The rates are as follows.

The employee standard personal allowance remains at 12570 per year or. Work out how many days each rate applied then work out the tax due for each. On their 2023 return assuming there are no changes to their marital or vision status.

LONDON Oct 3 Reuters - British finance minister Kwasi Kwarteng on Monday abruptly dropped his plan to eliminate the top rate of income tax part of. It will set the Personal Allowance at 12570 and the basic rate limit at 37700 for tax years. 13 April 2022.

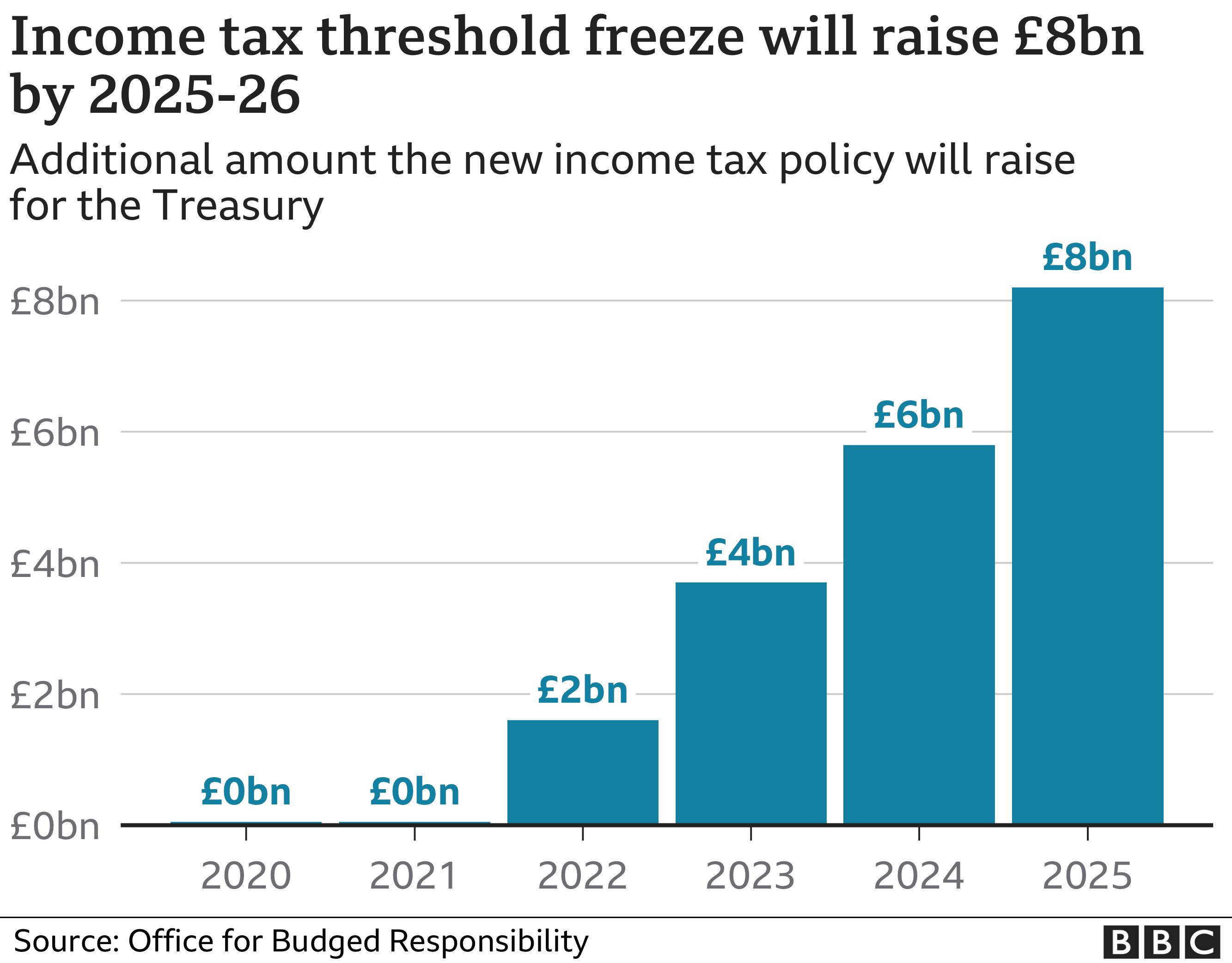

Running your own business means paying your own income tax. The threshold for higher-rate income tax in England Wales and Northern Ireland when workers start paying 40 per cent instead of the standard 20 per cent rate was frozen at. What are the tax rates for the 202223 tax year.

2022 to 2023 rate. Factsheet on Income Tax. The tax rates and bands table has been updated.

Basic rate band values for England Northern Ireland and Wales have been corrected from 37000 to 37700. At the Growth Plan statement on Friday 23 September 2022 the Chancellor announced changes to the Basic and Additional. Income Tax Rates and Thresholds Annual Tax Rate.

Basic rate Anything you earn from. The UK has a progressive tax system which means that higher earners are taxed at a higher rate. It will automatically calculate and deduct repayments from their pay.

There are seven federal income tax rates in 2022. PT Primary Threshold. As a result their 2022 standard deduction is 30100.

Income tax corporation tax and dividend tax.

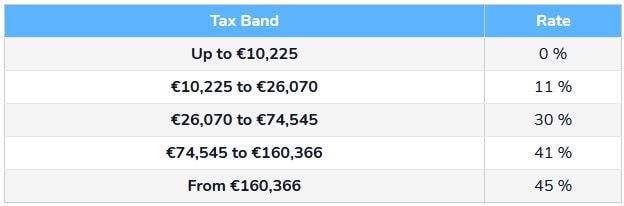

French Income Tax Rates For 2022 News For The Over 50s

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

How They Pay Their Way The Usa Versus Canada France Denmark Germany And The Uk In Six Charts Home

South Africa S Highest Tax Rate Vs The Uk Dubai Hong Kong And New York

Uk Government Abolishes Plan To Cut Tax On High Earners In Major U Turn

Uk Scraps Tax Cut For The Elites That Roiled Markets

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

Tax Year 2022 2023 Resources Payadvice Uk

Uk Income Tax Rates And Bands 2022 23 Freeagent

How Are Capital Gains Taxed Tax Policy Center

Uk Pm Truss Says No Shame In U Turn On Cutting Highest Income Tax Rate 04 10 2022 Sputnik International

Us New York Implements New Tax Rates Kpmg Global

Corporate Tax Rates Around The World Tax Foundation

2022 Corporate Tax Rates In Europe Tax Foundation

Scottish Budget 2022 2023 Sets Out Scottish Income Tax Changes Payadvice Uk

Budget 2021 Million More Set To Pay Income Tax By 2026 Bbc News